Our Programs

Five years ago, we had a dream of setting up a research-led university, focused on digital future and responsive to fast changing technology scenario. I am happy to report that DYPIU has moved faster than our expectations to fulfill this dream and become a trendsetter for the country.

D Y PATIL INTERNATIONAL UNIVERSITY

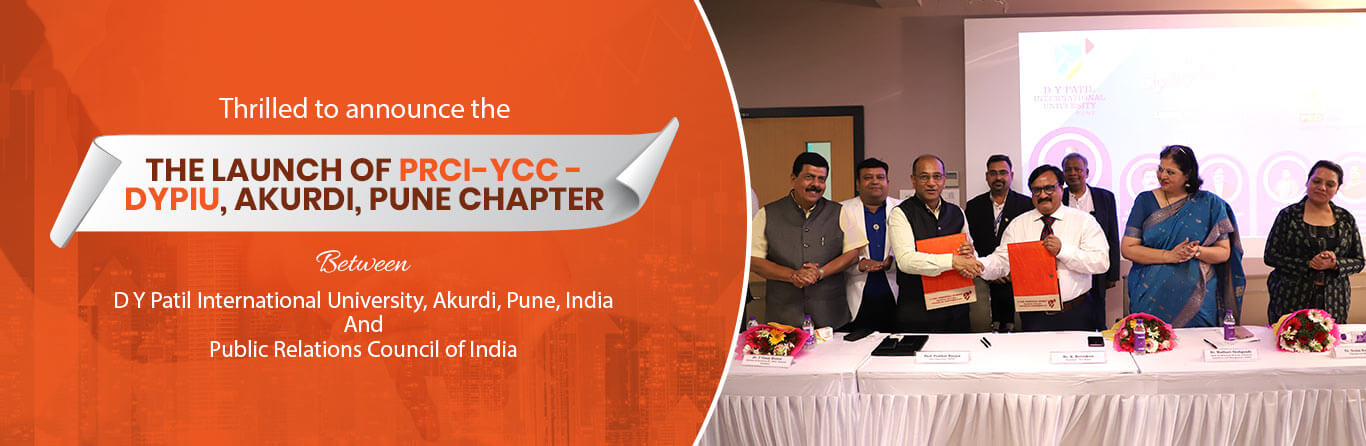

D Y Patil International University, Akrudi, Pune is one of the finest private universities in India, which is providing the highly-skilled talent to the nation and overseas. The university has recently become operational as a state private university and offering the best quality higher education in the field of engineering, management, international business, graphic design, biotechnology, journalism, and mass communication.

The university has been a pioneer in engineering education, research, and innovation, and ranked among the top ranked innovation-driven private universities in Pune. The university has established academic excellence and offering the best programs in innovative and emerging areas. The university has a world-class infrastructure and offering an inspirational and experiential learning environment to the students. We are the best university in India that constantly evolves its teaching methods and providing the best quality education to the students as per their unique interests and aspirations.

The university is counted at top position among the best engineering colleges in Pune, Maharashtra offering the top engineering programs with internships and hands-on-training right from the first year. We keep the quality of the curriculum, infrastructure, and teaching faculty unparalleled, and believe in encouraging thousands of young minds to excel in their field in India and abroad.

News

Episode 15 of the weekly news bulletin from the house of D Y Patil International University.

Read moreEpisode 14 of the weekly news bulletin from the house of D Y Patil International University.

Read moreEpisode 13 of the weekly news bulletin from the house of D Y Patil International University.

Read more

Episode 12 of the weekly news bulletin from the house of D Y Patil International University.

Read moreEpisode 11 of the weekly news bulletin from the house of D Y Patil International University.

Read moreWe extend our heartiest congratulations to Dr. Pallavi Jha (Assistant Professor - School of Media & Journalism) for successfully getting…

We extend our heartiest congratulations to Dr. Pallavi Jha (Assistant Professor - School of Media & Journalism) for successfully getting her article published in the Pravasi Indians Magazine . Dr…

Read more

We extend our heartiest congratulations to Dr. Parthsarthi Sen Gupta on the successful publication of the research article in Physical…

We extend our heartiest congratulations to Dr. Parthsarthi Sen Gupta on the successful publication of the research article in Physical Chemistry Letters (JPCL, IF=6.88) from American Chemical Society.

Read moreWe extend our heartiest congratulations to Ms. Shruti Varode on securing high AIR rankings in GATE 2023 exam.

We extend our heartiest congratulations to Ms. Shruti Varode on securing high AIR rankings in GATE 2023 exam.

Read moreEpisode 9 of the weekly news bulletin from the house of D Y Patil International University

Read more